Whether Fear or Ignorance, Crypto is Here to Stay

AZ Legislature is right to move public policy in the direction of accepted practice...

Prescott, AZ May 4, 2025…

***Full disclosure, I possess XRP, BTC, USDC, and several other tokens. I remain a skeptical fan, but I am a fan of the DeFi movement.

From a public policy perspective, state treasurers are legally bound to protect the assets under management (AUM). State treasurers are risk-averse by nature, so it is easy to understand why they might be reluctant to implement a cryptocurrency reserve strategy to grow the AUM through organic adoption of cryptocurrencies like XRP, BTC, and the like. However, the policymakers, the various legislatures around the nation, are the policymakers, not the state treasurers, and certainly not the governors.

The Overton Window has already shifted…

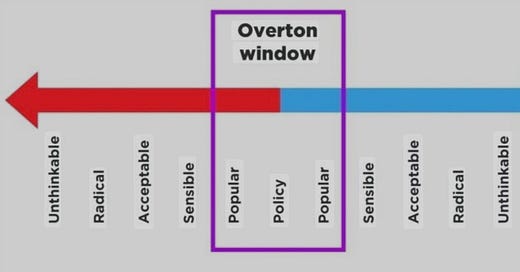

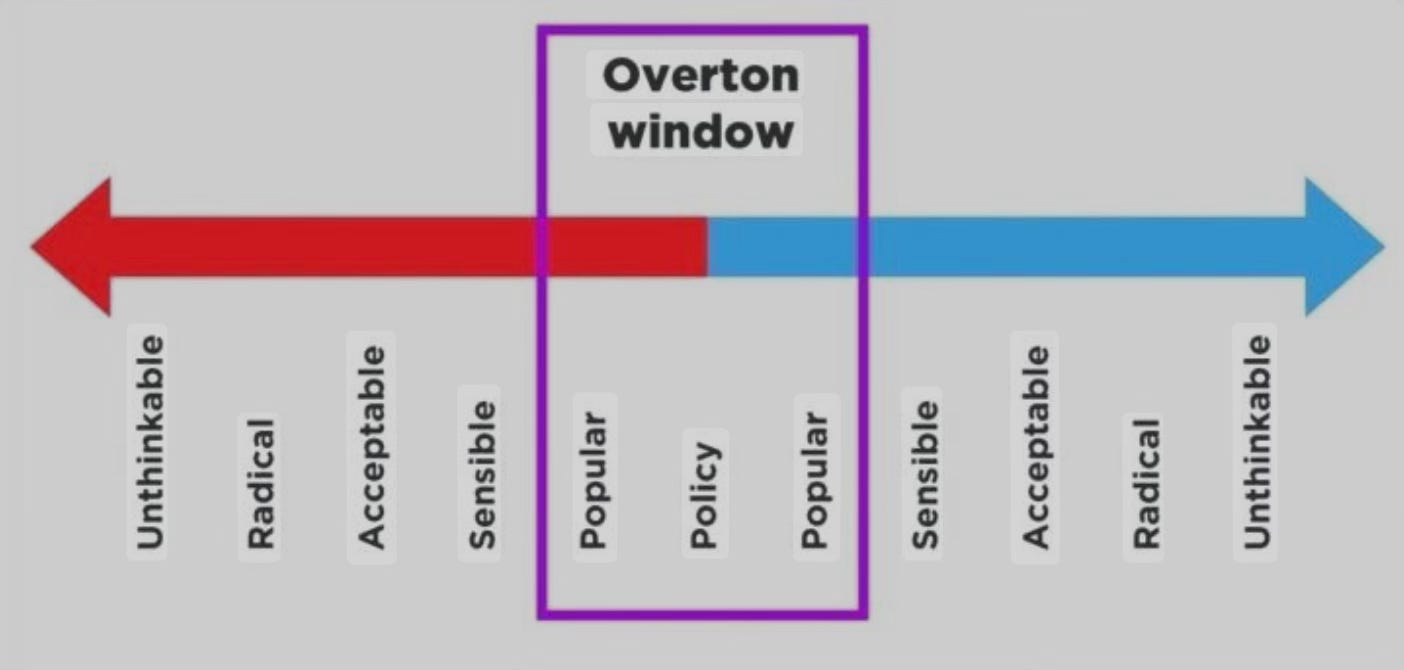

The Overton window is the range of subjects and arguments that are politically acceptable to the mainstream population at a given time. It is also known as the window of discourse by some. The foundation of the concept is that the “window” of opportunity to effect change will likely change over time. It can shift, shrink, or expand to reflect public sentiment on whatever challenge presents itself in the court of public opinion. It is a means to explain "the slow evolution of societal values and norms.

The organic adoption of cryptocurrency built on a blockchain framework, aka a public ledger, has grown exponentially over the last few years to the point where governments cannot adapt quickly enough to capitalize on the reality that Federal currency is no longer necessary to engage in commerce.

What is the purpose of currency? To facilitate commercial intercourse.

“Commercial intercourse" refers to trade or business dealings, especially between businesses, governments, or organizations. It essentially means the exchange of goods, services, or information for commercial purposes.

News flash to the state and federal government bodies: one can already buy and sell goods and services with cryptocurrency, and the decentralized financial (DeFi) system has already arrived. What does that mean to policymakers? DeFi is essentially democratizing money, no longer controlled by governments but by the marketplace. That is the Overton Window shift.

Who’s leading the way?

It seems to be a contest between the various state and federal governments. But as a contrarian, I propose that it is a myth. For sure, the state and federal governments have the “police” powers to regulate and tax, but it is the marketplace driving the bus now. The explosion of utilization has quickly outpaced the government’s regulatory framework. As partial proof, the SEC dropped its lawsuit against Ripple, ending the long-running legal battle over the cryptocurrency XRP. This decision comes after a 2023 court ruling that XRP sales on public exchanges were not securities. The SEC had appealed that ruling, but it has now dropped the appeal. Hum…

Several states have introduced or are actively considering permissive legislation for state treasurers to create, particularly for Bitcoin reserves. However, these bills are still in various stages of the legislative process and have not been enacted into law. Below is a summary of the relevant activity:

- **Arizona**: Legislation for a Strategic Bitcoin Reserve was introduced, with a contentious party-line vote in both the Senate and the House of Representatives. Democrats, especially Senator Mitzi Epstein (AZ LD-12), railed against the policy, claiming that cryptocurrency is too risky, unreliable, and untested. This reveals the level of ignorance in the minds of some policymakers who ignore the shifting reality of currency around them. When we consider the federal government’s moves, such as is nothing short of silly. And of course, the Democratic governor, proud to be the one who has vetoed more bills than any other, vetoed the bill. Apparently, the village idiot did not grasp the concept of a “permissive” law. It would have done nothing but permit the state treasurer to explore & perhaps acquire, if she saw fit [emphasis added], some amount of cryptocurrency.

- **Florida**: Listed among states that have introduced Strategic Bitcoin Reserve legislation. No evidence of passage.

- **Massachusetts**: Introduced legislation for a Strategic Bitcoin Reserve, noted as the 10th state to do so in January 2025. No passage reported.

- **New Hampshire**: A Bitcoin Reserve bill (HB302) passed a Senate committee with a 4-1 vote in April 2025, but there’s no indication it has been signed into law.

- **Ohio**: Introduced legislation for a Strategic Bitcoin Reserve, but no passage reported.

- **Oklahoma**: Included in the list of states with introduced Bitcoin Reserve legislation. No passage confirmed.

- **Pennsylvania**: Introduced legislation for a Strategic Bitcoin Reserve, but no passage reported.

- **Texas**: A bill to create a Strategic Bitcoin Reserve, with proposed annual purchases of $500 million in Bitcoin, was set for debate in April 2025. No confirmation of passage.

- **Wyoming**: Noted for introducing Strategic Bitcoin Reserve legislation. No passage reported.

- **North Dakota**: Introduced legislation for a Strategic Bitcoin Reserve, but no passage confirmed.

- **Alabama**: Listed as having introduced Bitcoin Reserve legislation. No passage reported.

- **Missouri**: A Bitcoin Reserve bill passed its first committee with no votes against in April 2025, but there’s no evidence of final passage.

What about the feds?

The U.S. Treasury has not actively acquired XRP or Bitcoin (BTC) for a strategic reserve through direct purchases. However, on March 6, 2025, President Donald Trump signed an executive order establishing a **Strategic Bitcoin Reserve** and a **U.S. Digital Asset Stockpile**.

Keep reading with a 7-day free trial

Subscribe to Mark Finchem's Inside Track Substack to keep reading this post and get 7 days of free access to the full post archives.